Cash Payments

Analysis Objectives and Sample Chart

ACG fraud detection models are designed to assists organizations in detecting possible fraudulent disbursements by using data mining and predictive modeling tools. Results summarized in a report can be used by examiners in their investigations. Payment types include: vendor bills, expense reports, payroll, grants, etc.

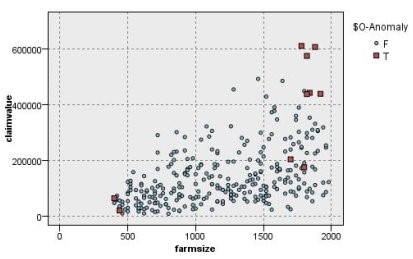

The following chart illustrates one of the reports from a payments project. The chart demonstrates how analytical methods can be used to detect deviations from the norm. These anomalies colored in red can be further investigated to determine if the payments were fraudulent in nature.

The models used in these types of projects enable the user to adapt to the changing patterns of fraudulent payment activities as they evolve in real time. The models are not dependent upon knowing the attributes of the last fraudulent payment to be effective.

Data Analyzed, Models Used and End Results Achieved

Models built using different algorithms are used to analyze past payment activity (including known fraudulent payments). The best model is selected based on scored performance relative to fraud sensitivity and capability of limiting false alarms.

The following indicators and tests are applied to payment data:

• Payments actually deviate from the normal by using Anomaly Detection methods.

• Payments addressed to P.O. Boxes.

• Invoices from the same vendor but paid to multiple addresses.

• Invoices from multiple vendors paid to the same address.

• Invoices from the same vendor that were not sequentially numbered on the date submitted.

• Submission of an unreasonably large number of expense reports from the same employee over a period of time.

Using the above indicators, the model identifies potential fraudulent activity for further investigation by the company’s staff.

Benefits Realized and Reference Case Study

• Reduce the substantial sum of money lost to fraudulent payments by assisting examiners in identifying the possible perpetrators.

• Build expert models to detect instances of fraud as payments are presented to the bank.

Click on the link entitled Improving Cash Payment Fraud Detection found in the Resource Center for the case write-up.