Treasury Operations: Credit and Collection

Reducing Bad Debt Expense by Modeling Customer Payment History

In this study, we looked at using company’s customer payment history as a method of measuring credit risk versus using generic Credit Bureau scores. Some of the negatives associated with Credit Bureau’s scores for monitoring existing customers include:

In this study, we looked at using company’s customer payment history as a method of measuring credit risk versus using generic Credit Bureau scores. Some of the negatives associated with Credit Bureau’s scores for monitoring existing customers include:

• The credit score and risk measurement for the customer is the same for everyone but the actual customer payment behavior is not the same for each user of the bureau data.

• Small and mid-sized companies and many global businesses don’t have bureau credit scores thus requiring manual reviews.

• Bureau data is expensive.

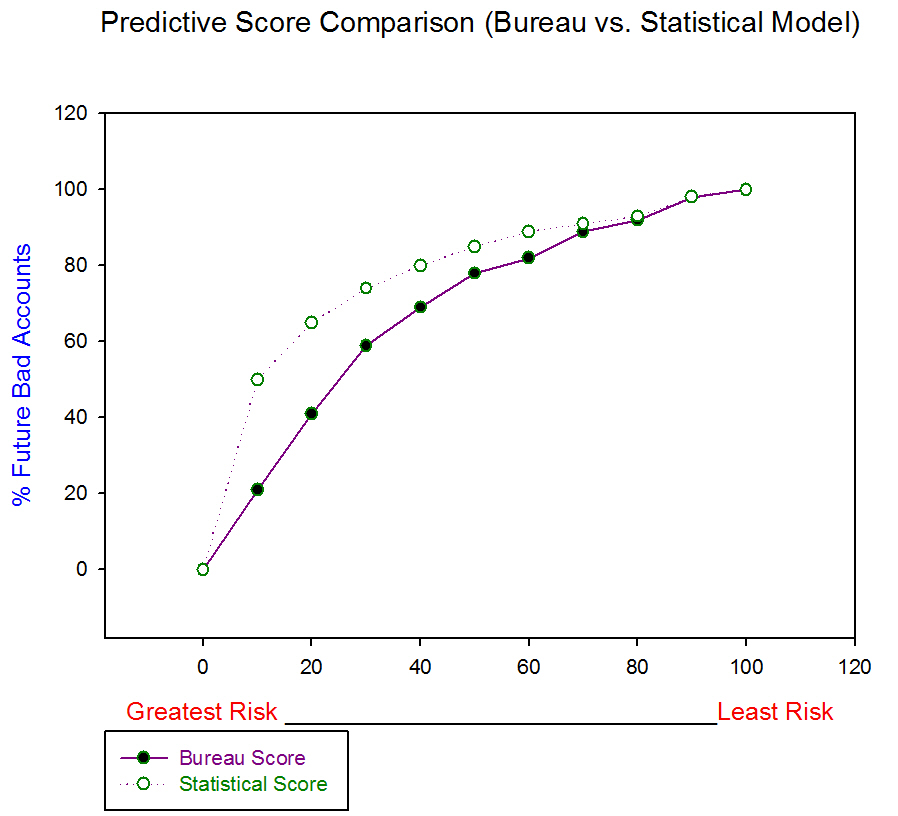

The objective of this study is to show how a company’s unique tolerance for risk (definition of bad – 60, 90, 180 day delinquency, etc.) and a statistical model are used to better prioritize who these higher risk customers are. The benefit from this effort is a more effective risked based collection strategy.

The statistical scoring model produces a risk probability which is used to derive the account’s cash as risk measure. These measures are then used to allocate collection resources not only in terms of when collect efforts start but also in terms of how the account is treated. For the worst accounts, the statistical scoring method captured about 90% more of the bad customers than the bureau scores.

Request a Download

When you request this report, we will also update you with information on new whitepapers, research studies and more. If you no longer wish to receive our emails you can unsubscribe at any time by sending us an email message using the Contact Us page.

By submitting your email address, you acknowledge that you have read the Privacy Policy and that you consent to our processing data in accordance with the statement.

If you have any questions, please email us at creig@analyticsconsultinggroup.com